- Overview of Exness and its reputation in the trading industry

- Importance of choosing the right Exness account for successful trading

- Types of Exness Accounts

- Exness Real Account Features and Benefits

- Purpose and Advantages of an Exness Demo Account

- Exness Account Types Overview

- How to Open an Exness Account

- Opening an Exness Demo Account

- Key Features and Tools Available in the Exness Broker Demo Account

- Account-Specific Information

- Frequently Asked Questions (FAQs)

Exness is renowned in the trading industry for its robust platform and diverse account options, catering to both novice and experienced traders. Selecting the proper account type is crucial for optimizing trading strategies and achieving financial goals.

Overview of Exness and its reputation in the trading industry

Exness stands out in the trading landscape due to its robust security measures, user-friendly interface, and regulatory compliance. Recognized globally, the platform garners trust by maintaining transparency and offering competitive trading conditions, making it a preferred choice among traders.

Importance of choosing the right Exness account for successful trading

The success of trading activities largely hinges on selecting an account that resonates with your trading style and financial objectives. Exness tailors its account types to fit various trading preferences, which helps in leveraging market opportunities effectively. Here’s why choosing the right account is vital:

- Risk Management: Different accounts offer varying degrees of risk exposure. Understanding these can help in aligning with your risk tolerance.

- Cost Efficiency: From spreads to commission rates, each account has distinct cost implications that can impact overall profitability.

- Access to Features: Certain accounts unlock advanced features and tools, essential for sophisticated trading strategies.

Selecting the appropriate account type at Exness empowers traders to optimize their trading approach, manage risks better, and increase potential returns.

Types of Exness Accounts

Exness offers a variety of account types to cater to different trading needs and strategies. Here’s a breakdown of the main categories:

- Standard Accounts: Ideal for newcomers, offering simpler features and no minimum deposit.

- Professional Accounts: Designed for experienced traders, these accounts feature tighter spreads and higher leverage options.

Exness Real Account Features and Benefits

The Exness Real Account is designed to cater to most traders’ needs, providing a balanced combination of features:

- Leverage Options: Flexible leverage up to 1:2000, allowing traders to magnify their trading position based on their risk appetite.

- Spread and Commission: Competitive spreads starting from 0.1 pips with no hidden commissions on the majority of instruments.

- Trading Instruments: Access to a wide range of markets including Forex, Metals, Cryptocurrencies, Energies, and Indices.

- Support and Tools: 24/7 customer support and access to comprehensive analytical tools to enhance trading decisions.

Exness Real Account Registration Process and Requirements

Registering for an Exness Real Account involves several steps to ensure security and compliance with financial regulations:

- Sign Up: Visit the Exness homepage and click on the ‘Open an Account’ button. Provide your email and set a password.

- Verification: Complete identity verification by submitting a government-issued ID. Provide proof of residence through a utility bill or bank statement not older than three months.

- Deposit: Choose from multiple deposit methods including bank transfers, credit cards, and e-wallets. No minimum deposit requirement for Standard Accounts, but Professional Accounts may require a specific initial deposit depending on the type.

- Account Configuration: Set your trading leverage based on your risk tolerance and strategy. Opt in for any additional features or tools available for your account type.

Following these steps will get your Exness Real Account up and running, ready for trading on one of the industry’s most trusted platforms.

Purpose and Advantages of an Exness Demo Account

An Exness Demo Account serves as a practical training ground for both novice and seasoned traders. It simulates real trading environments without the risk of losing actual money. Here are the key advantages:

- Risk-Free Learning: Allows beginners to practice trading strategies, understand market movements, and learn platform navigation without financial risk.

- Strategy Testing: Experienced traders can test new strategies and refine existing ones to see how they would perform in live markets.

- Platform Familiarity: Users can familiarize themselves with Exness’s tools and features, including charting tools, indicators, and order execution types.

- Market Experience: Provides a hands-on approach to understanding how different market conditions affect trading, offering insights into Forex, commodities, indices, and more.

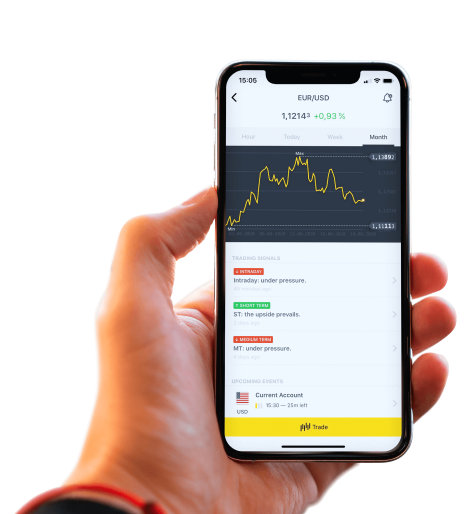

How to Open an Exness Demo Account and Start Practicing Trading

Opening an Exness Demo Account is a straightforward process designed to quickly get users started with trading practice:

- Visit the Exness Website: Access the official Exness website at www.exness.com. Navigate to the ‘Accounts’ section and select ‘Demo Account.’

- Account Creation: Click on the ‘Open Demo Account’ button. Fill in the registration form with required details such as email address and preferred trading platform (e.g., MetaTrader 4 or MetaTrader 5).

- Verification: While a demo account typically does not require extensive verification, you might need to confirm your email by clicking on a verification link sent to your registered email address.

- Customize Your Account: Set up your virtual balance, leverage, and other trading conditions similar to what you would use in a real trading scenario. Choose the currency for your virtual balance to better simulate your actual trading environment.

- Accessing the Platform: Once your account is set up, log in to your chosen trading platform using the credentials provided during registration. Download and install the necessary trading platform software if required, available directly through links provided in your account management area.

- Start Trading: Utilize the virtual funds to practice trades. Experiment with different trading instruments available on Exness. Use the analytical tools and indicators to help make informed trading decisions.

- Evaluate and Learn: Regularly review the trades you have made to understand what strategies are working. Adjust your trading methods and explore new techniques to improve your trading skills.

Opening an Exness Demo Account is an excellent step for anyone looking to delve into the world of trading without the pressure of risking real capital. It’s an educational tool that mirrors real market conditions and helps build confidence before transitioning to a real account.

Exness Account Types Overview

Exness offers a diverse range of account types to accommodate the varied needs of traders worldwide. Below is a detailed comparison of these accounts, highlighting their unique features and suitable trader profiles.

Exness Standard Account

- Features: Access to all trading instruments, no hidden commissions, and a minimum deposit of just $1.

- Benefits: Ideal for beginners and those testing new strategies with real funds, offering flexible leverage and moderate spreads.

Exness Micro Account

- Features: Tailored for micro trading with a minimum trade volume of just 0.01 lots.

- Benefits: Low-risk environment perfect for novice traders learning the ropes of real market conditions with minimal investment.

Exness Pro Account

- Features: Offers tighter spreads and higher leverage options, designed for professional traders.

- Benefits: Best suited for high-volume traders looking for optimal trading conditions and advanced features.

Exness Zero Spread Account

- Features: Zero spreads on major currency pairs, charging a fixed commission per lot traded.

- Benefits: Ideal for scalpers and high-frequency traders who benefit from no spread costs during trading.

Exness Cent Account

- Features: Trade with micro-lots using just cents as the base currency, allowing for very low-risk trading.

- Benefits: A great starting point for beginners wanting to trade with extremely low stakes and for testing strategies.

Exness Islamic Account

- Features: Swap-free accounts that comply with Sharia law, available on both Standard and Professional models.

- Benefits: Suitable for Muslim traders requiring compliance with Islamic finance principles.

Exness KWD Account

- Features: Account base currency in Kuwaiti Dinar, tailored for traders in or around Kuwait.

- Benefits: Minimizes currency conversion fees for those using KWD, making it cost-effective for local traders.

Exness ZAR Account

- Features: Account base currency in South African Rand, intended specifically for the South African market.

- Benefits: Offers local traders the advantage of managing funds in their domestic currency, reducing exchange rate risks.

Choosing the Right Account

Each Exness account type has its strategic advantages, depending on trading style, risk tolerance, and financial goals. Traders should consider the specific features and benefits of each to find the best match for their needs. Whether you are a beginner looking to get your feet wet with a Cent or Micro account, or a seasoned professional needing the advanced capabilities of a Pro or Zero Spread account, Exness has options to fit each trader’s requirements.

How to Open an Exness Account

Opening an account with Exness is a streamlined process designed to get traders set up and trading as quickly as possible. Here’s a step-by-step guide to opening your Exness account:

Step 1: Registration

- Visit the Exness Website: Go to Exness’s official website.

- Sign Up: Click on the ‘Open an Account’ button on the homepage.

- Enter Your Details: Fill in your email address and set a secure password. Agree to the terms and conditions to proceed.

Step 2: Account Verification

- Confirm Your Email: Check your email for a verification link from Exness and click on it to confirm your email address.

- Complete KYC Process: Upload your government-issued ID and a recent utility bill or bank statement as proof of residence. This step is crucial for complying with financial regulations and ensuring the security of your account.

Step 3: Account Configuration

- Choose Account Type: Select the type of account you wish to open (e.g., Standard, Pro, Zero Spread).

- Set Base Currency: Choose the currency you want to use for trading and account transactions.

- Configure Leverage: Decide on the leverage ratio that suits your trading strategy and risk management preferences.

Tips for a Smooth Account Setup

- Ensure Accurate Information: Provide accurate personal information during registration to avoid delays in the verification process.

- Understand the Terms: Familiarize yourself with the terms and conditions, particularly regarding account types, leverage, and trading policies.

- Use Demo Account: Consider starting with a demo account to practice trading strategies without financial risk.

By following these steps, you can set up your Exness account efficiently and start trading with one of the industry’s leading forex and CFD brokers.

Step 4: Deposit Funds

- Access the Deposit Section: Navigate to the ‘Finance’ section in your account dashboard and select ‘Deposit.’

- Select Payment Method: Choose from various payment methods available, including bank transfers, credit/debit cards, and e-wallets.

- Make a Deposit: Enter the amount you wish to deposit and complete the transaction following the instructions provided.

Step 5: Start Trading

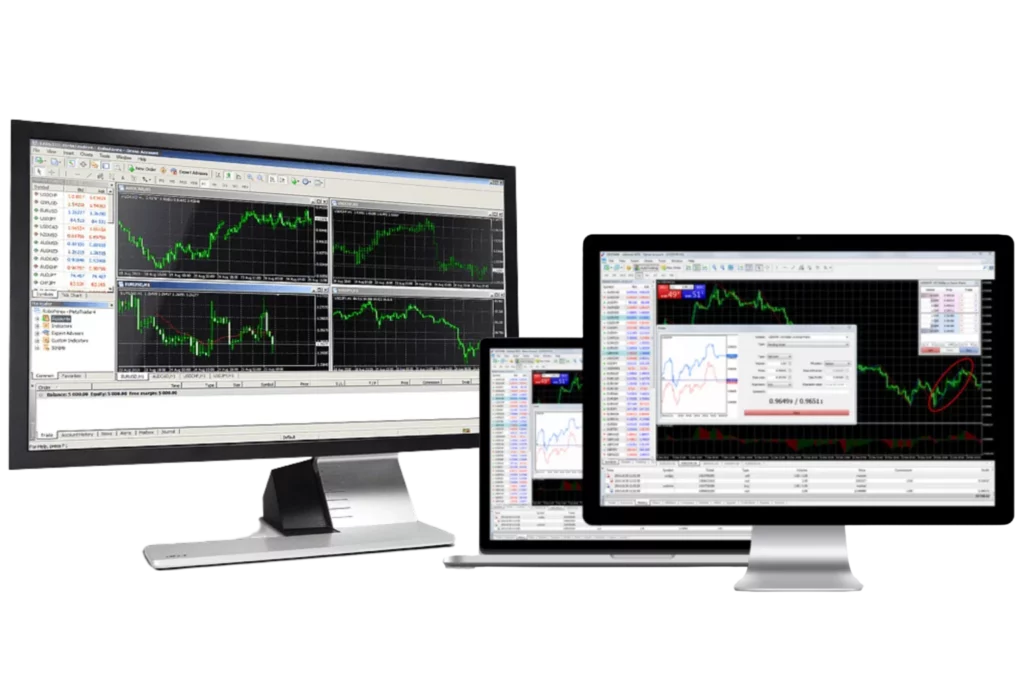

- Download Trading Platform: Download and install the trading platform linked with your account type, like MetaTrader 4 or MetaTrader 5.

- Access the Trading Interface: Log in with your account details.

- Begin Trading: Start trading by opening and managing your positions in the financial markets.

Opening an Exness Demo Account

Opening a demo account with Exness allows you to trade in a risk-free environment using virtual funds. This section will guide you through the steps to set up your Exness demo account, including registration and login procedures, and differentiate between the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) demo account platforms.

Steps for How to Open Exness Demo Account

- Visit the Exness Website: Access the official Exness site.

- Choose the Demo Account Option: Locate and click on the ‘Open Demo Account’ or a similar option.

- Registration Form: Fill out the registration form by providing necessary information such as your email address and desired password.

- Account Configuration: Configure your demo account settings, including choosing the trading platform (MT4 or MT5), setting your virtual balance, and selecting your preferred leverage.

Exness Demo Account Login and Registration

- Registration: Follow the registration steps above to create your account.

- Login: Once your demo account is created, log in by entering the username and password you set during the registration process. You’ll typically use the trading platform you selected (MT4 or MT5) to access your demo account.

Differences Between Exness Demo Account MT4 and Exness Demo Account MT5

- Platform Features: MT5 offers additional features like more timeframes, built-in economic calendars, and advanced charting tools compared to MT4.

- Market Access: MT5 supports more types of orders and allows trading in stocks, futures, and commodities in addition to forex, which might not be as extensively available in MT4.

- User Interface: MT5 has a more modern interface with additional windows and better customization options.

Opening an Exness Real Account

Transitioning to a real account with Exness involves a few more steps than setting up a demo account, including additional verification to comply with financial regulations.

Guide to Open Exness Real Account

- Visit the Exness Website: Go to the homepage.

- Select the Real Account Option: Click on ‘Open an Account’ and choose the real account option.

- Fill Out the Registration Form: Provide your personal information, including full name, email address, and contact details.

- Set Account Preferences: Choose your account type (Standard, Pro, etc.), base currency, and leverage according to your trading needs.

Documentation and Verification Required for Exness Real Account Registration

- Personal Identification: Submit a copy of a government-issued ID (passport, driver’s license).

- Proof of Residence: Provide a recent utility bill or bank statement that shows your full name and address.

- Additional Verification: In some cases, Exness may request additional documents or information to complete the verification process.

Tips for Smooth Account Opening

- Check Document Validity: Ensure all documents are valid and clearly readable.

- Follow Instructions Carefully: Pay close attention to the specific requirements for document submissions, such as accepted formats and resolution.

- Use Accurate Information: Double-check all the information you enter during registration to avoid delays in account activation.

By following these guidelines, you can efficiently set up both your Exness demo and real accounts, allowing you to practice trading strategies or actively engage in live trading.

Key Features and Tools Available in the Exness Broker Demo Account

The Exness Demo Account is equipped with several tools and features to help traders simulate real trading conditions effectively:

- Virtual Funds: Traders can use virtual funds to practice without financial risk.

- Real Market Conditions: Access to live market data and prices.

- Full Range of Instruments: Trade all the same instruments available in real accounts, including Forex, metals, cryptocurrencies, and more.

- Analytical Tools: Includes charts, technical indicators, and analytical objects to assist in making informed trading decisions.

- Platform Choices: Available on both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms.

Account-Specific Information

Exness Standard and Cent Accounts

Details on Exness Standard Cent Account Minimum Deposit

The Exness Cent Account allows traders to trade smaller volumes with a minimum deposit as low as 1 USD, making it ideal for beginners who wish to trade with lower risks.

Comparison of Exness Standard Account and Exness Cent Account

- Purpose: The Standard Account is geared towards general traders with no minimum deposit, offering more flexibility, while the Cent Account targets new traders looking to trade with minimal financial exposure.

- Trade Size: Standard Accounts have standard lot sizes, whereas Cent Accounts deal in micro-lots.

- Currency Units: Transactions in the Cent Account are denominated in cents, allowing finer control over trading volumes.

Special Account Types

Features of Exness Zero Spread Account

- Spread: Zero spread on major currency pairs.

- Commission: Charges a fixed commission per trade instead of spreads.

- Speed: Ideal for scalpers and those who prefer high-speed trading.

Overview of Exness Islamic Account and Exness KWD Account

- Exness Islamic Account: Swap-free, compliant with Islamic Sharia law, available for both Standard and Professional setups.

- Exness KWD Account: Designed for traders using Kuwaiti Dinar as their base currency, minimizing exchange rate fluctuations and conversion fees.

Exness ZAR Account Minimum Deposit Requirements

The Exness ZAR Account, tailored for South African traders, typically requires a minimum deposit of approximately 70 ZAR, although this can vary based on account settings and market conditions.

Frequently Asked Questions (FAQs)

What is an Exness account and how do I choose the right type?

An Exness account is a trading account offered by Exness, a global brokerage firm, which allows individuals to trade a variety of financial instruments. Choosing the right account type involves understanding your trading style, experience level, and financial goals:

- Beginners: Might prefer the Cent or Standard Account for lower risk and simpler setups.

- Experienced Traders: May opt for Professional, Zero Spread, or specific currency-based accounts like KWD or ZAR for optimized conditions.

- Cultural Compliance: Islamic traders can choose the Islamic Account for Sharia-compliant trading.